Tax Assessment for Hardware Wholesale Business

The tax assessment for a hardware wholesale business is crucial to ensure compliance with tax laws and to protect the financial interests of the business. The assessment process involves determining the taxable income of the business based on its sales, expenses, and profits. Additional factors such as the type of business, location, and ownership structure may also affect the tax assessment. It is essential to hire a professional tax advisor to ensure that the assessment is accurate and up-to-date with current tax laws. By undergoing a tax assessment, a hardware wholesale business can avoid penalties and fines for underpayment or non-payment of taxes, while also optimizing its tax obligations to ensure maximum financial benefits.

In the hardware wholesale business, tax assessment is a crucial aspect that needs to be addressed properly. The objective of this paper is to discuss the important considerations and factors that should be included in the tax assessment process to ensure compliance with the laws and regulations while maximizing the benefits for the business.

Firstly, it is essential to identify the taxable sales of the hardware wholesale business. This includes all sales made by the business to its customers, whether these sales are made in person, over the phone, or online. The taxable sales figure is crucial as it forms the basis for calculating the tax liability of the business.

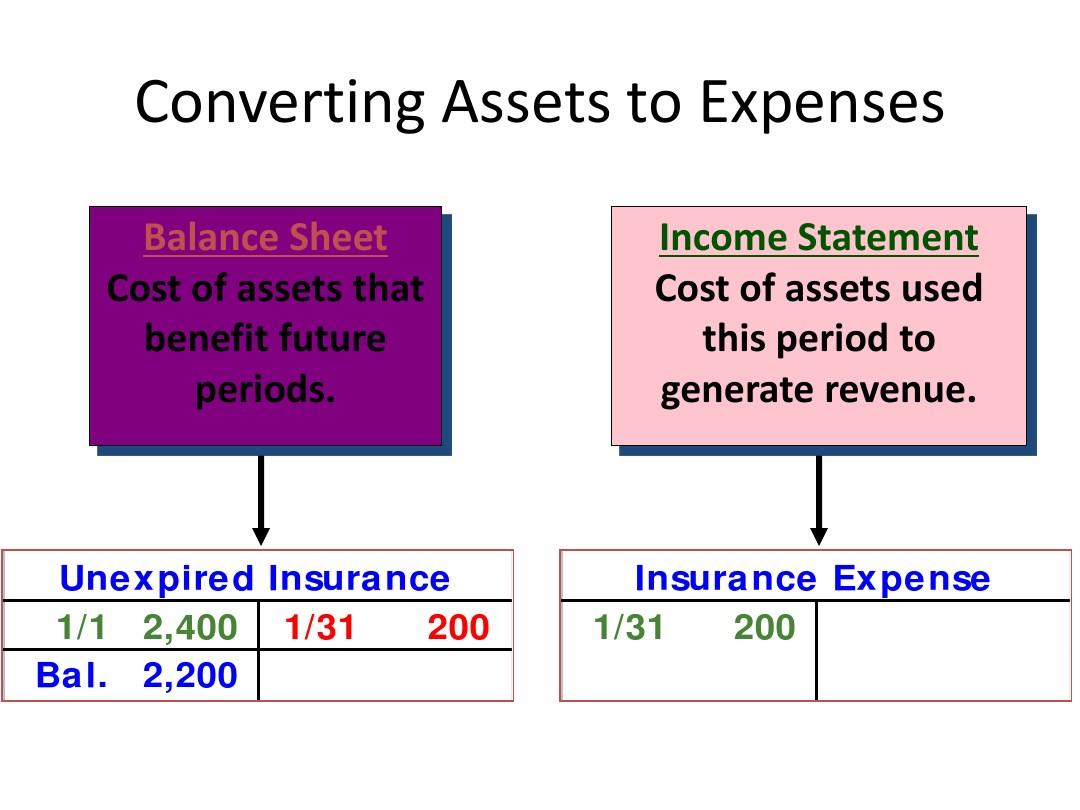

Secondly, the cost of goods sold (COGS) must be considered in the tax assessment process. COGS includes all the expenses incurred in purchasing the goods from suppliers, transporting them to the warehouse, and any other costs associated with making the goods available for sale. It is essential to calculate COGS accurately as it helps in determining the taxable income of the business.

Thirdly, the expenses of operating the business also need to be taken into account in the tax assessment process. These expenses include salaries and wages paid to employees, rent and utilities for the office and warehouse, marketing and advertising costs, and any other operating expenses that are necessary for running the business smoothly. It is important to classify these expenses correctly to ensure compliance with tax regulations.

Fourthly, the tax assessment process should also consider any applicable tax credits or deductions that are available to the business. These credits or deductions can reduce the taxable income of the business and hence its tax liability. It is essential to research and understand the various tax incentives offered by the government to ensure that the business is maximizing its benefits.

Lastly, it is important to prepare a detailed tax assessment report that summarizes all the figures and calculations made during the assessment process. This report should be reviewed and approved by a qualified accountant or tax advisor to ensure its accuracy and compliance with tax laws. The report should also include any recommendations made by the accountant or advisor to enhance the efficiency and profitability of the business.

In conclusion, tax assessment for hardware wholesale business is a complex but essential process that needs to be carried out properly to ensure compliance with tax regulations and maximize benefits for the business. By considering taxable sales, COGS, operating expenses, tax credits or deductions, and preparing a detailed tax assessment report, businesses can ensure that they are paying the right amount of taxes and comply with all applicable laws and regulations.

Articles related to the knowledge points of this article:

Title: Where to Source Building Materials and Hardware for Wholesale Purchase?

Silver Chi Hardware Wholesale: The Comprehensive Guide

Title: Wholesale Hardware, Lighting, and Bathroom Fixtures