Credit Management in the Hardware Store: A Guide to Managing Accounts Receivable

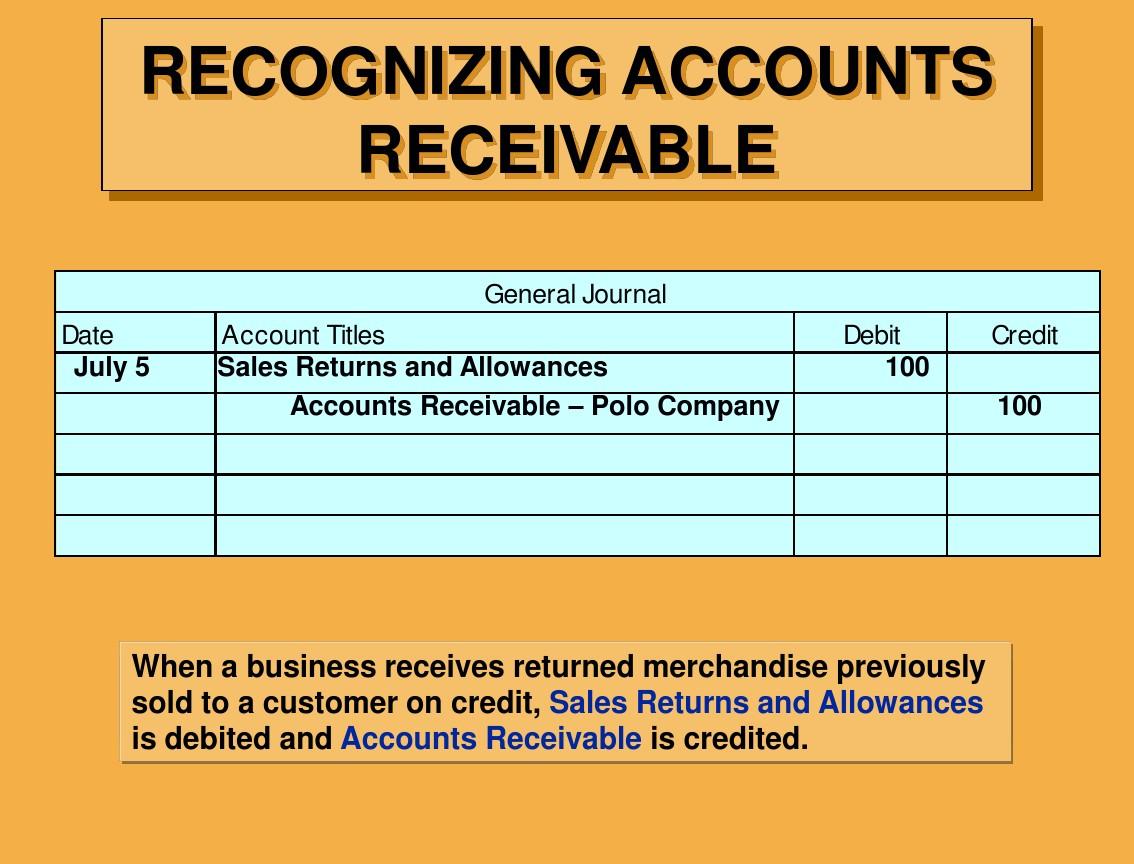

Managing accounts receivable is crucial in the hardware store, where cash flow is critical to the success of the business. Credit management involves evaluating customers' creditworthiness and managing their accounts accordingly. It is essential to establish clear credit policies, such as maximum credit limits and payment terms, and communicate them to customers. Additionally, it is important to monitor customer payments and collection efforts regularly to ensure timely payment and prevent bad debt. Effective credit management can help hardware stores maintain a healthy cash flow and reduce the risk of financial losses. By providing accurate credit information to customers and enforcing strict policies, hardware stores can build trust with their customers and create a positive reputation for their business. Overall, credit management is an integral part of running a successful hardware store, and it requires careful planning, monitoring, and communication to achieve its goals.

In the world of small business, cash flow management can make or break a company. For hardware stores, which often deal in large quantities of high-priced items with slow payment cycles, managing accounts receivable is especially critical. One strategy that many hardware store owners employ is to allow customers to "pay later," or to "open a credit account." This practice, while beneficial for businesses, also introduces new risks and challenges. In this article, we will explore the pros and cons of offering credit terms in your hardware store, and provide tips for effectively managing accounts receivable when you do.

First, let's consider the advantages of allowing customers to open credit accounts. For one thing, it can increase sales by making it easier for potential customers to afford your products. By giving customers a chance to pay over time, you are increasing the chances that they will complete their purchase, which can lead to increased revenue for your business. Additionally, offering credit can help build customer loyalty. Customers who feel good about their ability to pay over time may be more likely to return to your store, and may even tell their friends and family about your business.

However, there are also several potential downsides to allowing credit in your hardware store. The most significant risk is the possibility of non-payment. Even if you offer generous credit terms, some customers may still fail to pay their bills on time. If this happens repeatedly, it can put a significant strain on your cash flow, and potentially put your business at risk of financial failure. To mitigate this risk, it's important to carefully screen potential customers for creditworthiness before extending credit, and to set clear expectations about when payments are due and what happens if they are not paid.

Another challenge with offering credit in your hardware store is managing the accounts receivable process once you have given someone access to credit. Collecting on overdue accounts can be time-consuming and labor-intensive, and may require the assistance of a professional collections agency if you don't have the internal resources to handle it yourself. It's also important to ensure that you are following all applicable laws and regulations related to the collection of debts, as mistakes could potentially lead to legal trouble down the line.

Despite these challenges, many hardware store owners find that offering credit is a worthwhile investment for their business. To successfully manage accounts receivable when you do extend credit, here are a few key strategies:

Establish clear credit criteria from the start. This should include factors such as credit score, employment history, and debt-to-income ratio. You may also want to establish minimum purchase requirements to help ensure that customers are serious about paying for their purchases.

Use technology to your advantage. Many payment processing systems offer features that can help you manage credit accounts more efficiently. For example, you might use automated invoicing and reminders to keep track of accounts that are past due, or you might use software to analyze data on your credit accounts to identify patterns and trends.

Train your staff on best practices for handling accounts receivable. This includes training on how to screen potential customers for creditworthiness, how to communicate with customers about overdue payments, and how to work with collections agencies if necessary.

Monitor your credit accounts regularly

Articles related to the knowledge points of this article:

The Best Location for a Hardware Store

Nantong Hardware Store: A Beacon of Quality and Service

Electrician Hardware Store: The Quintessential Toolbox for Your Electrical Needs

Title: Exploring the Availability of Tripods in Hardware Stores: A Visual Exploration